When the lights flicker or a sudden surge fries your electronics, it’s natural to wonder: does home insurance cover electrical problems? The answer depends on why the problem occurred. Homeowners insurance is primarily designed to safeguard your home against unexpected damage not ongoing wear or neglected maintenance. That means if an electrical issue stems from a covered peril, such as a lightning strike, sudden power surge, or accidental fire caused by faulty wiring, your insurance may help cover the cost of repairs or replacements.

On the other hand, routine electrical failures, outdated systems, or code violations that result in damage are generally excluded from standard coverage. If your circuit breaker trips constantly or flickering lights trace back to aging components, these issues might be classified as maintenance-related and therefore not covered.

Understanding the details of your policy is crucial. If you’ve ever asked yourself, does home insurance cover electrical problems like the one I’m facing? — the best place to start is with a close review of your plan’s terms, exclusions, and optional endorsements. Being proactive with electrical inspections, system upgrades, and documentation can not only help you prevent future claims but also strengthen your position if a claim ever arises.

What Electrical Issues Are Typically Covered?

If you’re wondering if home insurance covers electrical problems, the good news is that some types of electrical issues are often included in a standard policy — particularly when they arise from sudden and accidental causes. Homeowners insurance is fundamentally designed to protect your home and personal property from unexpected events, not gradual wear and tear or poor maintenance.

Let’s take a closer look at the kinds of electrical problems your home insurance may actually help with:

✅ Power Surges from Lightning

Lightning strikes can cause powerful electrical surges that damage your home’s appliances, electronics, or even parts of the wiring system. If the surge results from a direct or nearby lightning strike, most policies consider this a covered peril. So if your flat-screen TV, refrigerator, or computer fries due to a surge, your policy may help pay for replacement or repair — minus your deductible, of course.

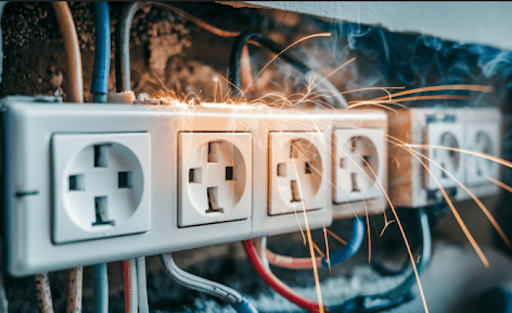

✅ Electrical Fires Caused by Wiring Failures

Electrical fires that break out due to hidden wiring defects, overloaded circuits, or failing breaker panels are usually covered, as long as you weren’t negligent. For example, if a hidden wire inside your wall overheats and sparks a fire that damages a section of your home, your homeowners insurance will typically:

- Pay for structural repairs,

- Replace damaged personal property,

- Cover temporary living expenses if you must relocate during restoration.

However, if the fire was caused by an electrical issue you ignored — like old, visibly damaged wiring that wasn’t repaired — your insurer might reject the claim.

✅ Fire-Triggered Structural Damage

Even if the electrical issue isn’t directly covered, the consequential damage it causes may be. For instance, if a circuit failure sparks a blaze that burns through walls or ceilings, the resulting structural damage is usually covered. The insurance company may pay to:

- Rebuild or repair burned sections,

- Restore insulation, drywall, and finishes,

- Replace personal belongings lost in the fire.

This is why early detection and documentation are so important. If the cause of the problem is traced to an insurable event, your policy can provide broad support.

✅ Damage to Appliances or Devices

In cases where a covered peril — like a power surge or fire — damages appliances or electronics, you may be eligible for compensation to repair or replace them. Some policies even allow for replacement cost coverage, which reimburses you based on the current market price rather than depreciated value.

🔍 Pro Tip: Keep receipts and take photos of high-value electronics and appliances for easier claims processing.

✅ Smoke and Soot Damage from Electrical Malfunctions

Even if a fire doesn’t break out fully, an electrical malfunction can cause smoke damage — staining walls, furniture, or clothing. Your policy may cover cleaning, deodorizing, and even professional remediation services to remove smoke residue, especially when it results from a sudden, unexpected electrical event.

Why Insurance May Not Cover Every Electrical Problem

Not every flickering bulb or blown fuse warrants an insurance claim. Policies are crafted to cover accidental, unforeseen damages — not issues caused by aging systems or homeowner neglect.

Here’s why certain claims might be denied:

- Negligence or improper installation: If your system was installed incorrectly or hasn’t been maintained, your claim could be rejected.

- Old electrical systems: Many policies limit or exclude coverage for homes with outdated wiring (like knob-and-tube or aluminum systems).

- Gradual deterioration: Damage that occurs over time, such as frayed wires or corroded connections, is usually considered maintenance-related.

The rule of thumb? Insurance is for the unexpected, not the preventable.

How Homeowners Insurance Handles Different Electrical Scenarios

Understanding how insurance treats various types of electrical problems can help you better prepare and protect your property. Here’s how coverage typically breaks down:

Power Surges

These sudden voltage spikes can fry televisions, computers, and kitchen appliances. If a lightning strike or covered peril causes the surge, most policies will reimburse you for the damaged electronics. Surges caused by utility company issues or faulty internal wiring may not be covered unless you have added endorsements.

Faulty Wiring and Circuits

Wiring failures pose significant fire hazards. If your wiring causes a fire, resulting structural and property damage is often covered. However, the cost to repair or replace the faulty wiring itself is rarely included — especially if your system is outdated or hasn’t been professionally maintained.

Flickering Lights

Flickering lights may seem minor, but they can signal bigger issues like loose wiring or overloaded circuits. If the cause ties back to a covered event like a fire or surge, the resulting damage may be covered. Routine flickers due to wear and tear? Likely not.

Overloaded Circuits

If too many appliances on one circuit cause overheating or a fire, insurance may help repair fire-related damage. But fixing the overloaded breaker or adding circuits falls under homeowner maintenance.

Frequent Outages

Extended power outages can damage electronics or food supplies. While your insurer won’t pay to fix downed power lines or public transformers, you might receive compensation for spoiled food or surge-damaged items — again, if it stems from a covered event.

Which Factors Influence Whether You’re Covered?

When asking does home insurance cover electrical problems, the answer often depends on a variety of case-specific factors. Insurance providers look at the cause of the problem, condition of your electrical system, and details of your policy before deciding whether your claim will be approved. While some incidents may seem straightforward, even a small oversight can make or break your coverage eligibility.

Here are the key factors that can influence whether your electrical damage is covered:

1. Type of Incident

This is the most critical factor. Homeowners insurance typically does cover electrical problems if they’re caused by sudden, accidental events, such as:

- A lightning strike causing a power surge that damages electronics.

- An electrical fire started unexpectedly due to a faulty outlet.

- Storm-related power surges damaging appliances.

However, if the issue developed slowly — such as frayed wires, overloaded circuits from improper use, or degraded outlets — these are often categorized as maintenance issues and are generally excluded from coverage. In other words, gradual deterioration is your responsibility, not your insurer’s.

2. Condition and Age of Your Electrical System

Older homes are charming, but they can present major insurance challenges. If your electrical system is outdated — like those with knob-and-tube wiring or undersized breaker boxes — your insurer may:

- Require you to upgrade before issuing a policy.

- Offer reduced or no coverage for electrical-related damage.

- Deny claims related to preventable issues in an aged system.

To ensure that home insurance covers electrical problems, homeowners should modernize their systems and maintain thorough documentation of all updates or inspections.

3. Policy Exclusions and Endorsements

Not all insurance policies are created equal. Some may have specific exclusions for electrical-related issues, especially if those problems are deemed preventable. Others may require you to purchase endorsements or add-ons for certain protections, like surge damage or high-value electronics.

Take time to:

- Review your policy in full (not just the summary page).

- Ask your agent specifically about what is and isn’t included regarding electrical systems.

- Consider riders or extended coverage if you live in an area prone to electrical issues.

4. Claim History

If you’ve previously filed one or more claims related to electrical damage, your current claim could be scrutinized more closely. A pattern of repeated claims for similar problems — especially if caused by the same underlying issue — may:

- Lead to a denied claim.

- Trigger an increase in your premiums.

- Even result in policy cancellation in extreme cases.

Make sure that once a problem is identified, it’s resolved completely and professionally so it doesn’t come back to haunt you — and your coverage.

5. Documentation and Preventive Efforts

Insurers are more likely to approve claims when you can show that:

- Your electrical system is up to code.

- You’ve had professional inspections.

- You’ve made timely upgrades or repairs.

- The damage wasn’t caused by neglect.

Save invoices, inspection reports, permits, and even photos when possible. These records can serve as evidence that you’ve fulfilled your responsibilities, increasing the likelihood your electrical issue will be considered a covered peril under your homeowners policy.

Who Plays a Role in Preventing Electrical Problems?

When it comes to maintaining a safe home, the responsibility squarely falls on the shoulders of the homeowner. While your insurance policy may provide a safety net, it’s not a substitute for proper upkeep. Insurers expect you to be proactive in maintaining your property — especially when it involves something as critical (and potentially dangerous) as your electrical system.

If you ever need to file a claim and wonder does home insurance cover electrical problems, one of the first things your insurer will examine is whether the damage could have been prevented with regular maintenance. If it was avoidable, your claim might be denied.

To reduce the risk of problems — and to increase your chances of successful claims when legitimate electrical issues do arise — here are some homeowner responsibilities to keep in mind:

- Schedule regular electrical inspections: At least every few years, have a licensed electrician assess your home’s wiring, outlets, circuit breakers, and electrical panel. This helps catch issues before they escalate into safety hazards.

- Replace outdated wiring: If your home has aluminum or knob-and-tube wiring, it’s time for an upgrade. These older systems are not only inefficient but also often uninsurable. Many insurance companies either refuse to cover such homes or severely limit the coverage offered.

- Avoid circuit overloads: Plugging too many devices into the same outlet or extension cord can strain your system, leading to overheating or even fire. Distribute electrical loads appropriately using grounded outlets and certified power strips.

- Invest in surge protection: Power surges can destroy appliances, electronics, and even internal wiring. Install whole-house surge protectors or use individual surge-protected power strips for expensive electronics like TVs, computers, and smart appliances.

- Keep documentation of repairs and upgrades: Whether you replaced an old breaker panel, rewired a section of the house, or installed surge protection, document everything. Save invoices, inspection reports, and warranties. This paperwork can be critical during the claims process to prove your diligence.

By taking these steps, you demonstrate to your insurance provider that you’re not neglecting your electrical system. This can help you avoid coverage exclusions that stem from poor maintenance. Moreover, keeping your electrical system in top shape protects your family from risks like electrocution, fire, and property damage — and ultimately ensures that when you do ask the question, “does home insurance cover electrical problems?”, the answer is far more likely to be “yes.”

Final Thoughts

So, does home insurance cover electrical problems? The answer is yes — but with several important caveats. Homeowners insurance can offer financial protection when electrical issues arise due to sudden and accidental events like lightning strikes, electrical fires, or power surges. In such cases, policies typically help cover the cost to repair damaged structures, replace personal belongings, and even restore parts of the electrical system impacted by the event.

However, the story changes when the issue is tied to gradual wear and tear, outdated wiring, or lack of routine maintenance. These types of problems are often seen as the homeowner’s responsibility and are therefore excluded from standard coverage. For example, if your wiring is over 40 years old and hasn’t been updated, your insurer might deny a claim related to electrical faults, even if a fire results.

To ensure your policy is working for you — and not against you — you need to be proactive. Regular electrical inspections, timely repairs, and keeping detailed records of maintenance and upgrades can help strengthen your position if a claim becomes necessary.

Additionally, consider talking to your insurance provider about optional endorsements or policy riders that specifically enhance coverage for electrical components. These can be especially helpful if you live in an older home or an area prone to power surges.

In short, while homeowners insurance can cover electrical problems, whether it will in your specific case depends on the cause, your policy’s details, and how well you’ve maintained your system. Always read the fine print and consult your insurer if you’re uncertain. By staying informed and prepared, you’ll avoid costly surprises — and keep your home protected when it matters most.

Clearing Up Confusion

1. Does homeowners insurance cover electrical panel upgrades?

Generally, no. Electrical panel upgrades are considered part of routine home maintenance. Insurance only covers repairs after a covered event causes damage to the panel.

2. Will insurance cover damage from a power surge if caused by a utility issue?

Not always. Many standard policies exclude surges caused by utility company errors unless you have an endorsement or special coverage.

3. Is old wiring like knob-and-tube covered under homeowners insurance?

Usually not. Most insurers exclude coverage for outdated systems unless they’ve been upgraded. Even if covered, premiums may be higher.

4. Can I file a claim if my appliances were damaged by flickering lights?

Only if the flickering was due to a covered event, like an electrical surge or fire. Routine flickering caused by wear and tear is not covered.

5. Does homeowners insurance cover the cost to inspect electrical problems?

Inspections are generally considered a homeowner’s responsibility. However, if the inspection follows a covered incident (like a fire), those costs may be reimbursed as part of the claim.

For more insights and expert advice, keep an eye on Homify Magazine. Stay inspired, stay informed!